5.0

124+Call

215-713-4178

Will Homeowners Insurance Cover Roof Replacement?

The Philadelphia Area’s Top Roofing Contractor

When your roof needs to be replaced, it’s common to wonder whether or not your homeowners insurance policy will cover the cost. There are many situations where this could be the case, but there are just as many where your policy will not pay for the replacement. At Philadelphia Quality Roofing, our roofing experts want to help you understand when and how a roof replacement might be covered by your homeowners insurance.

Understanding Homeowners Insurance Coverage

Homeowners insurance policies generally cover damages that are sudden and accidental. They are meant to protect your home against unforeseen disasters. However, the coverage for roof replacement depends on the cause of the damage and the specifics of your policy.

Common Covered Perils

- Weather Damage: This is one of the most common reasons for roof damage claims. If your roof is damaged due to a hailstorm, tornado, windstorm, or similar natural event, insurance may cover the cost of replacement.

- Fire and Smoke: Damage caused by fire may be covered, including the expenses for roof replacement if necessary.

- Vandalism and Malicious Mischief: If your roof suffers damage due to acts of vandalism, your insurance policy may cover the repair or replacement costs.

Exclusions and Limitations

- Age of Roof: The age of your roof plays a significant role in insurance claims. Many insurers have specific guidelines about roof age. If your roof is older than 20 years, some policies may only cover its actual cash value, which considers depreciation rather than the cost of a new roof.

- Maintenance Issues: Insurance does not cover issues that arise from wear and tear or poor maintenance. It’s expected that homeowners perform regular upkeep. If a roof is leaking due to neglected maintenance, the replacement costs may not be covered.

- Material Type: Some roofing materials may be excluded from coverage due to their shorter lifespan or higher maintenance requirements. Always check your policy or speak with your agent to understand which materials are covered.

Filing a Claim for Roof Replacement

- Document the Damage: Take clear photos or videos of the damage as soon as possible. This documentation can be crucial for your insurance claim.

- Review Your Insurance Policy: Understand the specifics of your coverage, including any deductibles and coverage limits.

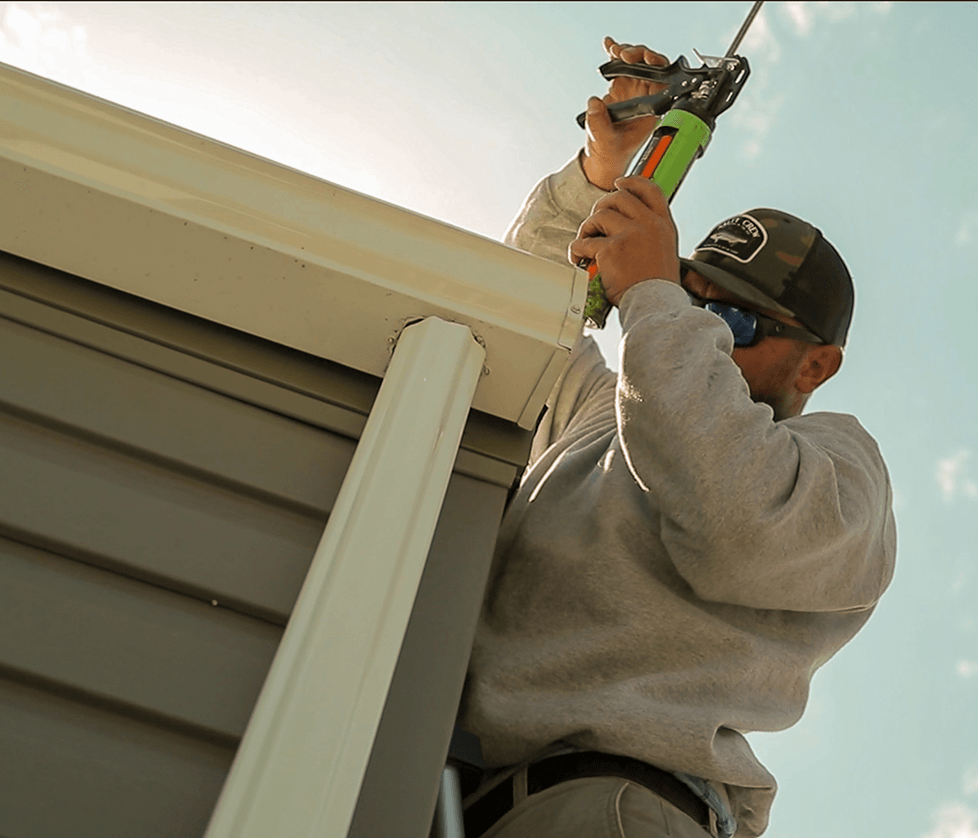

- Contact a Professional Roofer: Before filing a claim, it’s wise to have a professional roofing contractor assess the damage. Our team at Philadelphia Quality Roofing can provide you with a detailed report on the condition of your roof.

- File the Claim Promptly: Contact your insurance company as soon as you have all necessary documentation and reports. Delaying the claim process can complicate matters.

Pro Tips for a Smooth Insurance Claim Process

- Maintain Your Roof: Keep records of all inspections, repairs, and maintenance done on your roof. Regular upkeep may not only extend the life of your roof but also support your case when filing an insurance claim.

- Understand Your Policy: Knowing the details of your policy, including the deductible and what types of roof damage are covered, can help you anticipate the possible outcomes of your claim.

Contact Our Philadelphia Roofing Contractor Today

At Philadelphia Quality Roofing, we recommend consulting with both your insurance provider and a professional roofing contractor to navigate the claims process effectively. Our team is here to assist you with the expertise needed to handle roof assessments, repairs, and replacements. Contact our Philadelphia roofing contractor today to schedule your service!